Vietnam’s Power Market Shift: What 30-Minute Pricing Means for Clean Energy

Vietnam’s power market is evolving from a state-run, single-buyer model to a more flexible, market-driven system. Recent reforms—such as the Vietnam Wholesale Electricity Market (VWEM), the 30-minute Full Market Price (FMP), and the Direct Power Purchase Agreement (DPPA)—signal a shift toward greater transparency, competition, and support for clean energy solutions.

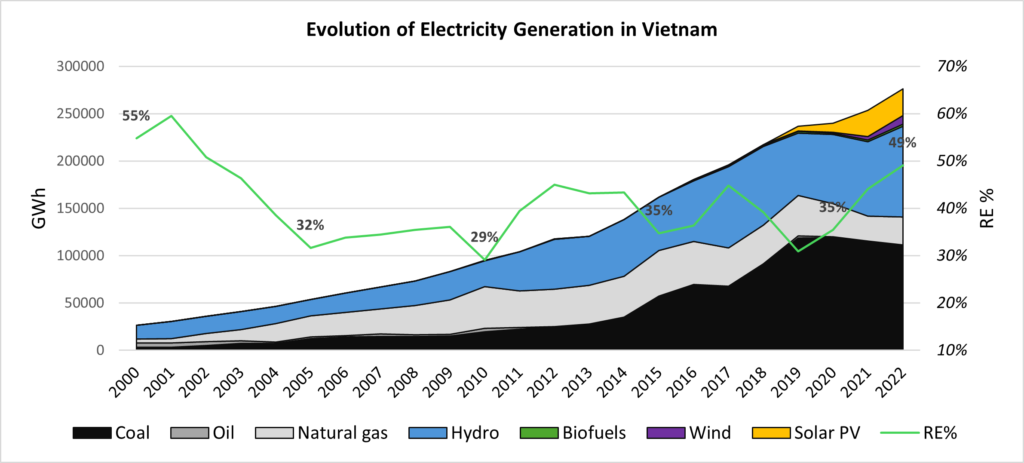

Vietnam’s clean energy transition is gaining pace. Coal still leads, but its share dropped to 40% in 2022, down from 50% in 2019, as renewables, especially solar and wind, expanded rapidly. The government’s COP26 pledge to phase out unabated coal by the 2040s has reinforced this shift. By 2022, renewables made up 49% of total generation, with solar and wind contributing 14%. This growth, along with rising corporate demand for clean power, underscores the need for market systems and tracking tools that enable real-time, verifiable clean energy use.

Figure 1. Evolution of electricity generation in Vietnam. Source: IEA.

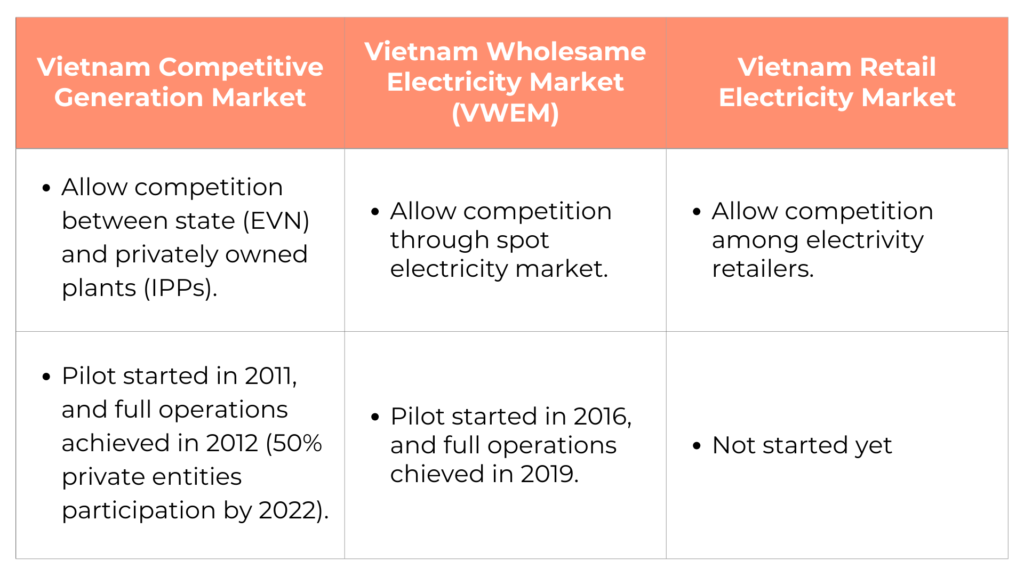

Vietnam’s Electricity Market

Vietnam’s move toward a competitive power system took a big step forward with the launch of its Wholesale Electricity Market (VWEM) in 2019. In this market, state and private generators sell electricity through a centrally coordinated system. Prices are based on real-time supply and demand, bringing more transparency and efficiency to the sector.

Table 1. Source: EnergyTag.

Vietnam Wholesale Electricity Market (VWEM)

VWEM operates as a gross pool where generators bid to supply power, and distribution companies buy electricity for their regions. End consumers in Vietnam, including large industrial users, currently cannot purchase electricity directly from the wholesale market.

However, this is beginning to change with the rollout of the Direct Power Purchase Agreement (DPPA), which enables large consumers to contract with renewable generators through a Contract-for-Difference (CfD), settle transactions via the VWEM using the Full Market Price (FMP), and receive power through the national grid. While not full market participation, this model simulates it and lays the groundwork for broader access in the future.

This Full Market Price (FMP)

Vietnam’s power market operates on a 30-minute trading system, with prices updated every half hour. This Full Market Price (FMP) reflects the real-time cost of power and is used to settle payments in the wholesale market.

The FMP includes:

- System Marginal Price (SMP) – a dynamic price based on supply and demand.

- Capacity Add-on (CAN) – a fixed payment to cover investment and fixed costs.

Though consumers don’t yet pay based on FMP, this pricing signal improves transparency and provides a strong foundation for innovations like DPPA.

The Direct Power Purchase Agreement (DPPA): A Parallel Track

Vietnam’s ambition to decentralize and green its electricity procurement pathways took a major step forward with the introduction of the Direct Power Purchase Agreement (DPPA) mechanism. Initially launched via Decree No. 80/2024/ND-CP, the policy framework was significantly refined in Decree No. 57/2025/ND-CP, issued on 3 March 2025, which replaced its predecessor.

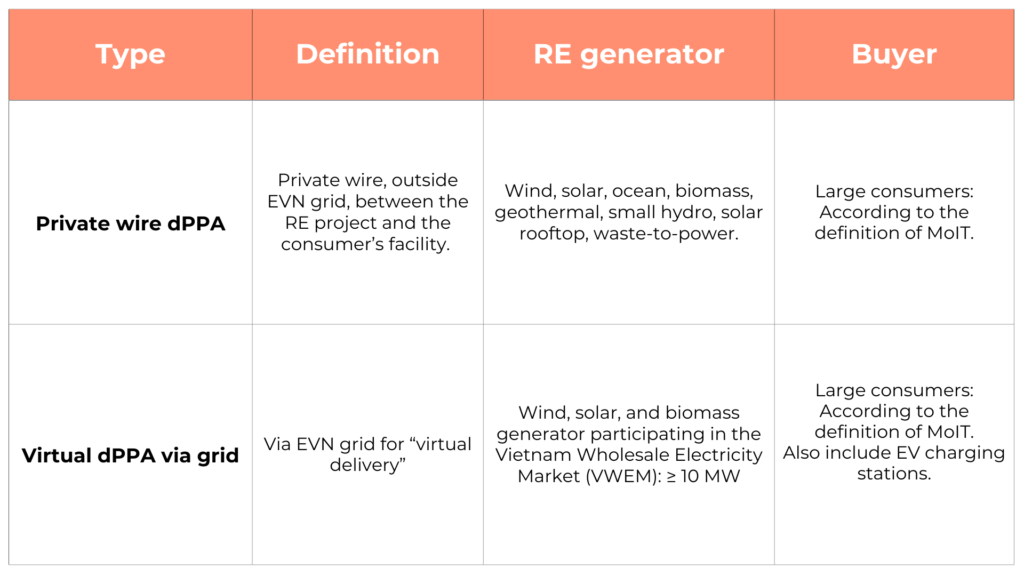

Under Decree No. 57, the DPPA framework retains two core models:

- Private wire DPPA – Direct power sale via a private connection between a renewable energy generator RE generator and a large power consumer.

- Virtual DPPA via grid – A virtual DPPA where RE generators sell electricity into the VWEM and enter into financial Contracts-for-Difference (CfD) with consumers who continue to be physically supplied by the grid.

Table 2. Type of dPPA. Source: EnergyTag.

Note: Excess power (≤ 20% of the actual power output) can be sold to EVN at average electricity market prices under Private wire dPPA.

Private wire dPPA:

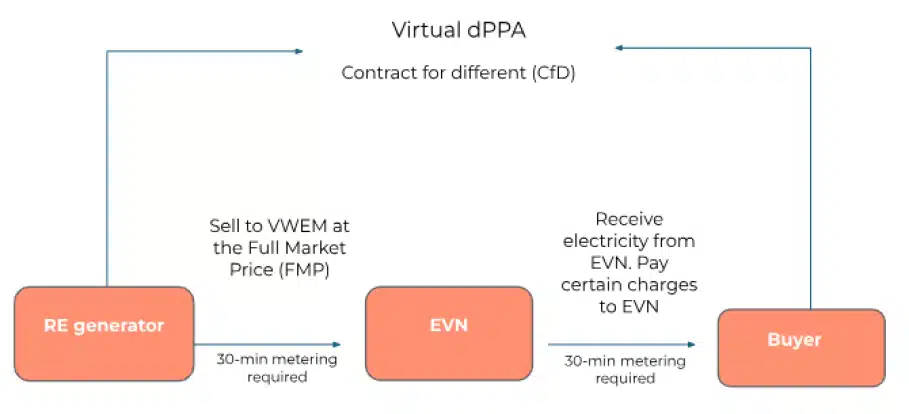

Virtual dPPA via grid:

Figure 2. Private wire and virtual DPPA. Source: EnergyTag.

Under the virtual dPPA mechanism, large consumers enter into a Contract for Difference (CfD) with renewable energy generators. While power is physically delivered through the national grid, financial settlements mimic a direct power purchase agreement. The charges typically include:

- Agreed PPA Price (CfD Strike Price):

A negotiated price agreed upon in the PPA that serves as the strike price for CfD settlement.

- If the VWEM price (spot market price) is lower than the PPA price, the consumer pays the difference to the RE generator via EVN.

- If the VWEM price is higher, the RE generator refunds the difference to the consumer.

- CDPPA: A power system usage fee paid to EVN for using the national grid to deliver electricity.

- CCL (Difference Clearing Charge): A regulated surcharge applied to recover system-wide costs not covered by the VWEM price, such as payments to Build-Operate-Transfer (BOT) plants, multi-purpose hydro facilities, non-market generators, and currency fluctuation adjustments.

- Additional Charges (if RE supply is insufficient):

- CBL: The retail tariff is applied only if the consumer’s total electricity usage exceeds the generator’s actual supply.

- CDN: The spot market tariff is paid to EVN to procure the shortfall electricity from the grid.

The use of the 30-minute Final Market Price (FMP) as the reference point for CfD settlements is particularly significant. This price signal brings wholesale market volatility into corporate energy decisions. It creates an opportunity for aligning time-stamped Energy Attribute Certificates (EACs) to match actual renewable generation on a granular basis.

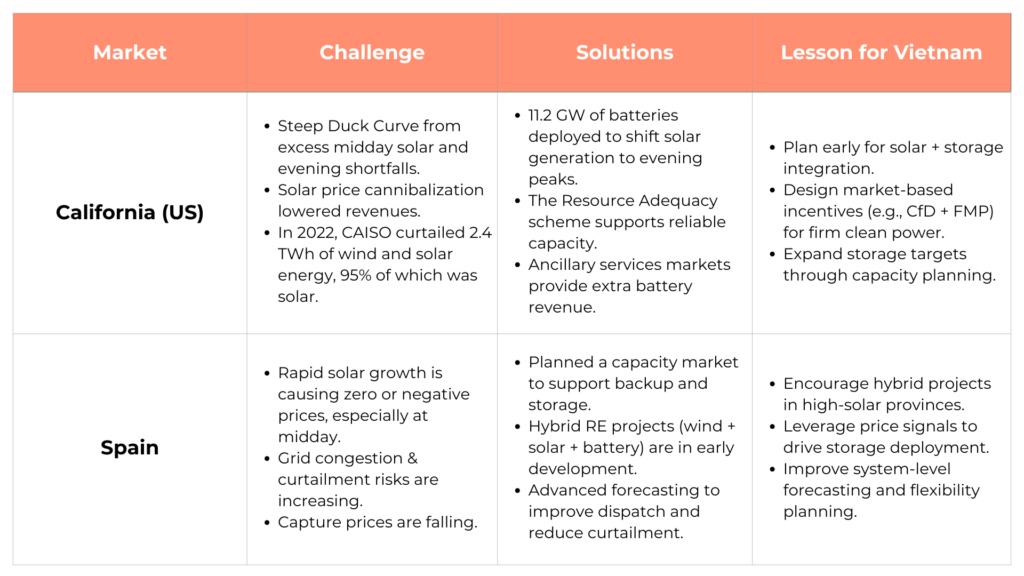

RE Integration Case Studies: Lessons from California & Spain

Scaling renewable energy must go hand-in-hand with system planning. As solar grows, both California and Spain show that overgeneration during the day can lead to price cannibalization, curtailment, and grid reliability issues unless paired with storage and smarter market designs. Vietnam can get ahead by applying these lessons early.

Table 3. Source: Find out more in the Comparative Report – California and Spain Energy Markets.

A Global Shift Toward Time-Based Tracking

Initiatives like the UN 24/7 Carbon-Free Energy Compact, the 24/7 CFE Coalition, and the EnergyTag standard are accelerating the move toward hourly matching of renewable generation and consumption. The EU’s green hydrogen certification rules also require time-aligned clean electricity.

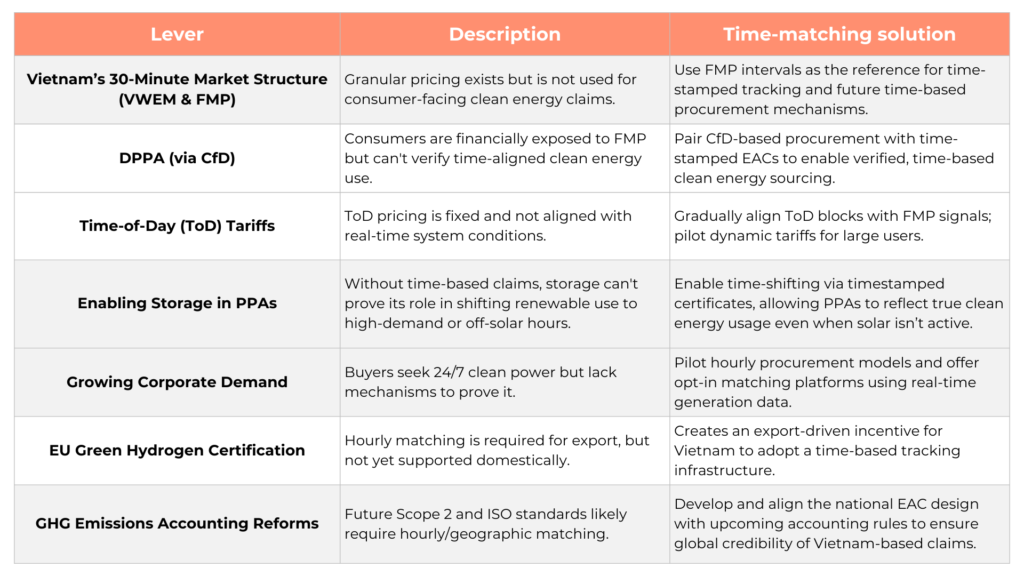

The table below highlights existing levers Vietnam can build on to enable time-based tracking:

Table 4. Source: EnergyTag.

The country’s 8th National Power Development Plan (PDP8) targets 2,700 MW of storage by 2030, including 300 MW of Battery Energy Storage Systems (BESS). With limited progress on pumped-storage hydropower, BESS could help manage renewable energy fluctuations.

While FMP alone does not track renewable attributes or enable time-based certificates, its regular pricing intervals could serve as the foundation for a time-based renewable energy tracking framework.

A Missed or Emerging Opportunity?

Despite its promise, Vietnam does not yet have a national EAC framework, such as RECs in the U.S. or Guarantees of Origin (GOs) in the EU. A government-recognized EAC system will be critical to support time-based tracking. In the meantime, voluntary time-stamped certificates such as EnergyTag’s Granular Certificate can help meet corporate demand for credible renewable energy claims.

Another limitation is that electricity consumers cannot yet access the wholesale market directly, restricting their ability to respond to real-time prices or generation availability. Opening the market to large consumers would unlock competition and support the deeper integration of renewables.

Vietnam’s 30-minute market signal is rare in the region. If supported by traceable time-stamped certificates, grid data transparency, and broader market reform, it could position Vietnam as a regional leader in time-based clean energy tracking.

Looking Ahead: Recommendations

Establish a national EAC framework: Develop a government-recognized energy attribute certificate system to support credible, time-aligned renewable energy claims. Use Vietnam’s 30-minute price intervals as a reference for aligning certificate issuance and clean energy usage.

Pilot time-based / granular certificate schemes: Launch pilot projects, especially under the DPPA, that test and validate time-stamped certificates for corporate procurement and grid integration. These pilots can be designed in line with the EnergyTag Standard, which provides internationally recognized guidance for issuing and managing Granular Certificates (GCs). Aligning with EnergyTag ensures that Vietnam’s early efforts are interoperable with global best practices and ready to support credible 24/7 clean energy claims.

Enable consumer access to wholesale markets: Allow large consumers to participate in wholesale markets to promote competition and real-time clean energy engagement.

Vietnam’s Wholesale Electricity Market and 30-minute Full Market Price (FMP) mechanism represent a powerful yet underutilized foundation. With the right policy and market support, they could anchor a transparent, time-based, and competitive clean energy system. Whether this becomes a missed opportunity or a catalyst for change will depend on the choices made today by policymakers, energy buyers, and market actors. Vietnam has the tools. Now it needs the intent and coordination to lead the region toward a smarter, cleaner energy future.