Scope 2 Updates Strengthen Clean Energy Markets

Changes are coming to GHG Protocol emissions accounting rules. High-integrity updates can drive the voluntary clean energy market towards effective decarbonization, not peril. Contrary to such alarmism, we argue that “doing good” starts with reality-based emissions accounting.

“Scope 2” electricity emissions are making headlines because the Greenhouse Gas Protocol (GHGP) – the standard used by 97% of reporting S&P 500 companies – is being updated for the first time in 10 years. These new rules will be finalized by 2027 and likely phased in over multiple years, putting them in place for the critical next phase of power sector decarbonization through the 2030s.

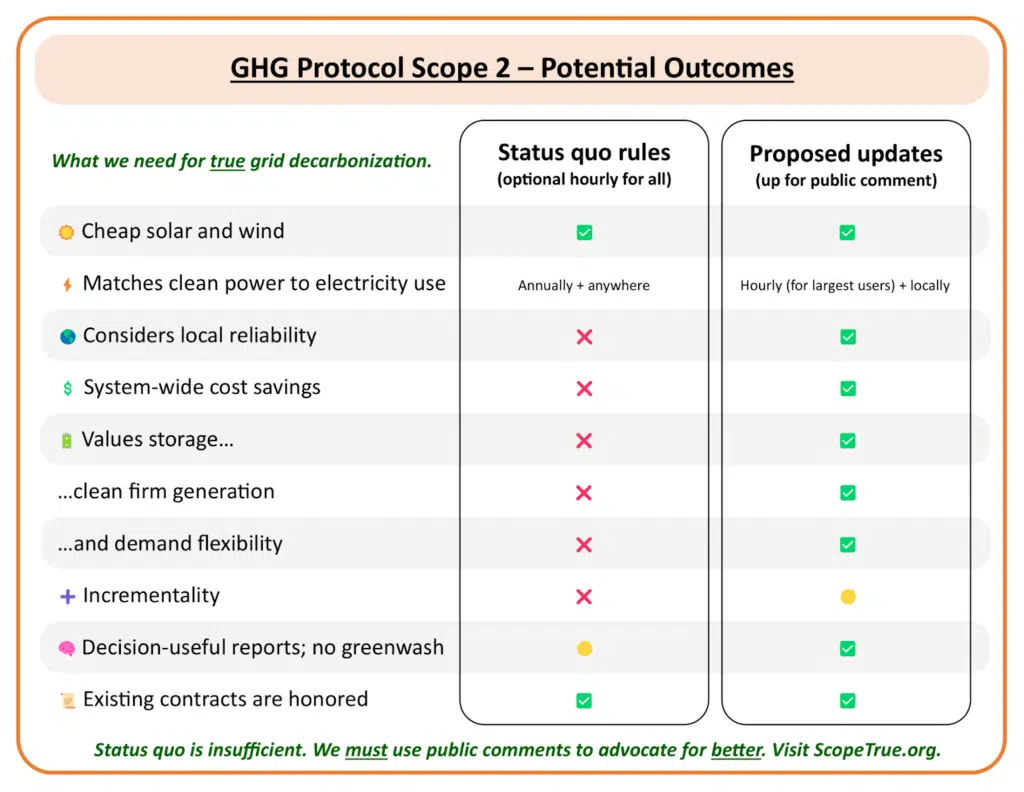

It is crucial these new rules:

- Continue to enable the momentum of voluntary procurement (>120 GW procured in the US to date).

- Transition to a more robust emissions accounting method that properly incentivizes the storage, clean firm power, and demand flexibility needed for cost-effective renewable integration.

- Fix today’s misleading corporate clean energy claims. How we measured progress in 2015 should not be how we measure it in 2040.

Some have made the case that stricter rules for clean energy claims could slow voluntary procurement or shift it to lower-impact forms. We argue that the Scope 2 proposal – which is open for public comment to shape its form – provides the opportunity to balance extra rigor for the largest companies with sufficient flexibility to ensure broad participation. This will incentivize both cost-effective and high-quality procurement, aligning clean energy market incentives with broader market incentives and grid realities.

If you are unfamiliar with the proposed updates, check out this concise post first to get the overview.

Incentivizing Procurement That Brings Higher Value to the Grid

Some of the world’s largest energy users and most profitable tech companies have been “100% clean” under current rules for years, despite their rising data center emissions. Today’s market allows claims that defy common sense. Besides making claims more honest, proposed changes drive key advances in grid firming and cost allocation for more affordable decarbonization.

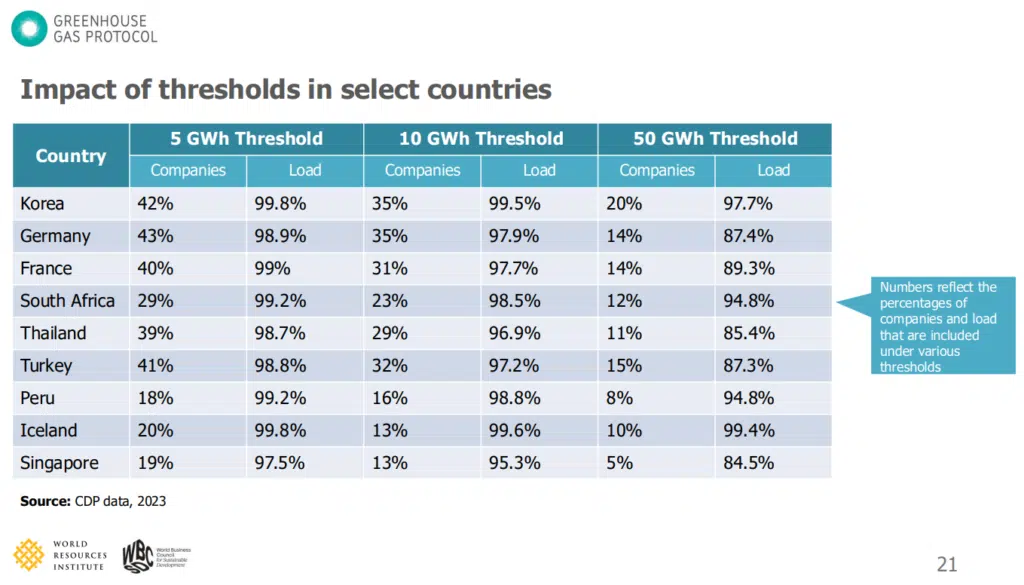

Largest companies lead. Proposed updates only require the largest electricity users in the world to do hourly accounting, while the majority of companies may continue using annual matching. This “exemption threshold” is a key element up for public comment, as it will define “how large” and “how many” companies must take this leadership role.

This GHGP analysis shows that across a variety of markets, a moderate exemption threshold captures the vast majority of load (over 95% in many cases) while only requiring a minority (usually less than a third) of companies in a market to do hourly matching. This is an effective flexibility, easing burdens for most companies, especially those that are underresourced, while applying more impactful and higher integrity rules to the energy users that dominate the grid.

Requiring only the largest, best-resourced companies to do hourly matching would create demand pull for round-the-clock clean energy everywhere while still maintaining sufficient feasibility for broad GHGP participation by small and medium-sized companies.

Companies like Meta, which InfluenceMap shows generally do not favor these new rules, are actually already pursuing procurement strategies aligned with proposed changes. One analysis finds them at ~79% hourly matching already. Of course, this is not the 100% claim they may prefer, but this transparency could incentivize them to pursue procurement strategies and technologies that fill their real clean energy gaps – and could provide a more accurate picture of new gas energy reportedly being built for their planned data centers in Louisiana and Ohio.

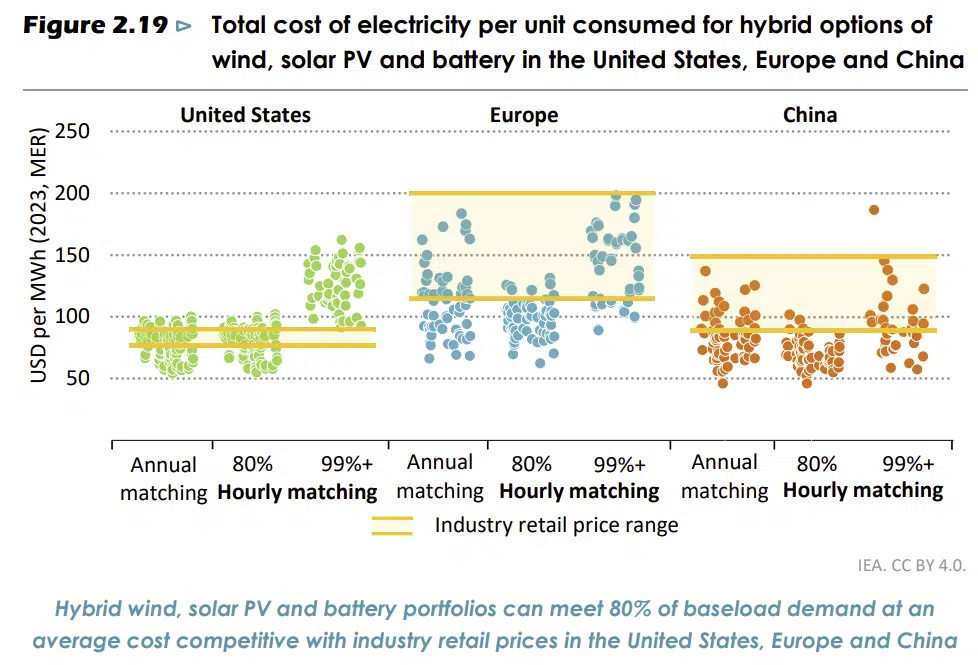

Hybrid Renewables Are Becoming Cost-Competitive

As numbers from the IEA above show, hourly matching of hybrid renewables (wind, solar, and batteries) is becoming cost-competitive today with standard industrial retail electricity tariffs and annual matching up to ~80% precisely because they both hit low-hanging fruit before doing important firming to get rates up to 99%+. Arguing against hourly matching is essentially arguing that renewables, storage, and flexibility will never be up to the task of delivering firmed clean power, and that we will always need fossil fuels for that. The IEA analysis casts doubt on this narrative. These hybrid renewable deals are emerging (e.g,. in Australia, India, or the US) and need to scale much more. Hourly matching for large consumers in the GHG Protocol can help incentivise these products and cover the premiums that still exist today.

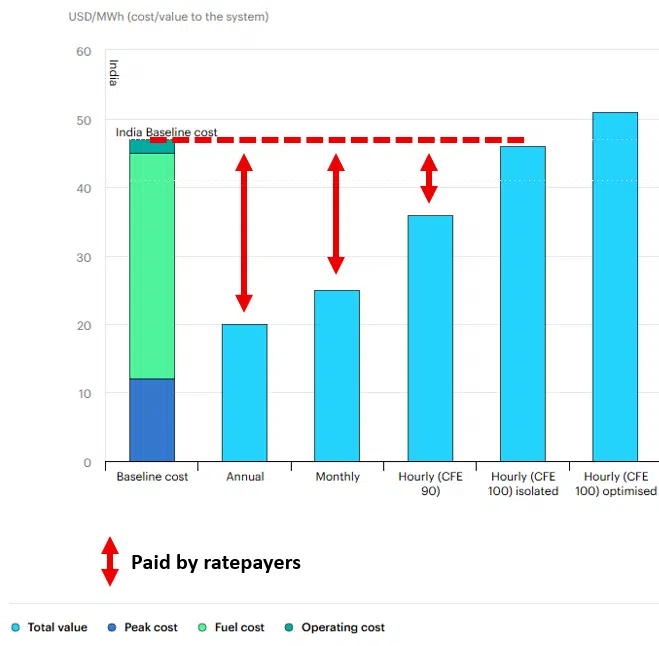

Grids and ratepayers can save money. Analyses by the IEA and Transition Zero show hourly-matched portfolios bring higher system value to the grid than annually-matched ones. In other words, less-firmed annual portfolios induce grid reliability costs borne by all ratepayers, while corporate procurements with higher hourly matching ensure these costs are borne by the companies, making them better grid stewards and delivering a more efficient, affordable grid for all.

This IEA figure (emphasis added) demonstrates how higher hourly-matched portfolios bring far more value to the system than annually-matched ones. This makes corporate buyers better grid stewards, bringing reliable, all-day clean power to the grid while minimizing balancing costs that grid operators (and therefore ratepayers) must cover.

It must also be noted that a “legacy clause” in the proposal should ensure existing contracts signed under current rules are honored – a fact some leave out of their arguments to make the changes seem too drastic. All discussions as to how these rules will shape the future of the clean energy market should assume a legacy clause for existing contracts; any discussion without this included is disingenuous.

The Realities of Today’s Clean Energy Markets

Clean energy buying generally falls into different sophistication levels today, which will continue under any updated rules:

- Most buyers heavily rely on unbundled EACs (Energy Attribute Certificates; a blanket term for certificates that are sometimes specified as RECs, GOs, etc.) of varying quality to reach their goals, along with supplier contracts. Unfortunately, this is not limited only to buyers with fewer resources or procurement options – many huge companies also over-utilize these today, for which they are getting increased scrutiny.

- Well-resourced buyers enter into PPAs with economical resources. ~90% of PPA volume reported to CDP is procured by the only ~10% of huge companies with >1,000 GWh of annual load, with the breakdown of physical vs virtual PPAs (VPPAs) discussed later.

- A few leading companies have already signed more “shaped” and/or “first-of-a-kind” PPAs that may even cost a premium. These will be more incentivized under the proposed rules.

A concern status-quo supporters have raised is that proposed changes will increase reliance on “spot market” unbundled EACs and make long-term contracts less attractive, reducing overall impact. Let’s take a look.

Getting Unbundled EACs in Check

The reality is that unbundled EACs are already the norm, comprising 35-39% of claims reported to CDP and RE100, respectively. New rules, at the very least, will make this type of procurement more accurate and rigorous (a point CDP lays out well on pg. 34 of their 2024 report). We encourage high-impact contractual procurement for those who can, but arguments against the proposed changes risk entrenching the far weaker status quo reliance on unbundled EACs that have no restrictions on where and when they can be purchased and applied.

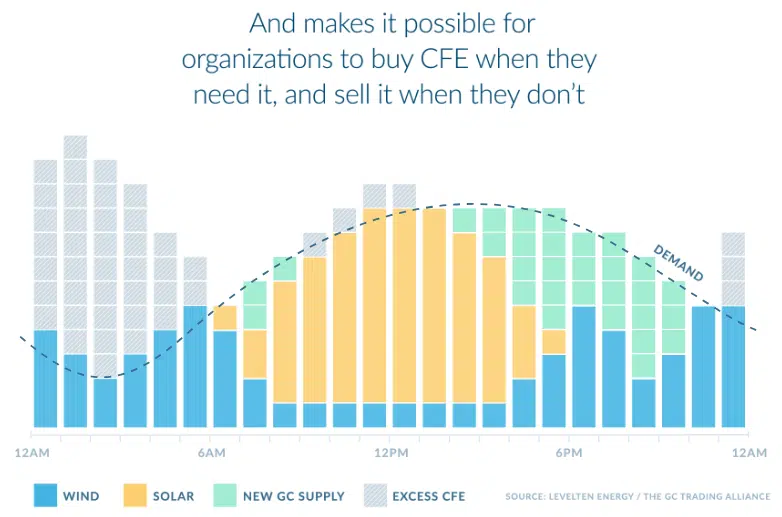

Unbundled EACs are plentiful and lower-impact today precisely because they can be claimed anywhere, anytime. They are undifferentiated and cheap. Proposed rule changes will differentiate the value of these EACs by hour and location, and organizations like LevelTen are already facilitating these transactions today. Proposed rules more closely align clean energy markets with how grids actually work – power prices famously have sub-hourly granularity, and they certainly have locational boundaries smaller than entire continents.

This is a vast improvement over the current situation and a key investment signal that is nonexistent in today’s rules. PPAs will still be incentivized as options for trading hourly EACs scale, painting a much clearer picture of the most valuable opportunities for investment in harder-to-decarbonize hours.

This graphic from LevelTen Energy shows how granular certificates (GCs) – hourly EACs – provide investment signals for carbon-free energy (CFE) to fill the gaps in demand left by wind and solar, in addition to allowing entities to sell excess CFE generation they may have.

Concerns of over-reliance on unbundled EACs vs PPAs for these harder-to-decarbonize hours quickly fall apart: those valuable EACs can only materialize after someone builds the clean-firm project generating (or discharging) those EACs, which will likely be financed by a PPA with a large local offtaker – who has real clarity and incentives around truly decarbonized portfolios because of new rules.

Proposed updates also fairly allocate EACs from existing public generation like old hydro, instead of today’s rules, which allow the highest bidding companies to gobble them all up. An alternative and potentially stronger methodology could simply be an asset age limit. We encourage respondents to engage on this incrementality pillar in the consultation.

Shaping Strong Procurement Into the Future

High-quality contracts that are physically delivered to load today are perfectly suited to proposed rule changes, because they typically have greater alignment with the time and location of company operations. Those are the norm in Europe and Asia, offering higher impact and electricity price hedging benefits.

PPAs will flourish. The argument that companies will not commit to long-term PPAs unless it can completely detach generation from their load in time and space does not hold water. Companies will still (as today) want the consistent source of EACs, higher impact, and hedged power prices PPAs offer when matched to the real-world demand of the consumer in time and space. That’s how most power markets work. Updated accounting rules may just mean their true decarbonization journey will begin at a more honest matching score.

And that is important – it should not be easy to claim high rates of hourly clean electricity matching, because deep decarbonization is hard work. For companies that want to aspire higher, they would have the incentive and clarity in direction to procure a diverse portfolio of renewables, storage, clean firm, and/or demand flexibility to fill all their hours with clean electricity. The proposed changes are not a “24/7” requirement; they simply raise the bar on making clean electricity procurement claims.

In a recent blog post, PPA market experts Pexapark said the proposed move to hourly and local matching by the GHG Protocol “could help increase the attractiveness of hybrid PPAs or multi-technology PPAs and help to increase the willingness to pay a premium for hybrid PPAs”. Pexapark is not advocating a position, but the benefits of reality-based accounting for hybrid PPAs are clear. That’s good for the PPA market, particularly in places like Europe, where negative prices and lack of storage in PPAs have contributed to a significant reduction in PPA volumes in 2025.

And while it may become harder to claim “100% clean power,” it will not be much harder to calculate and report what your Scope 2 numbers are, as illustrated below.

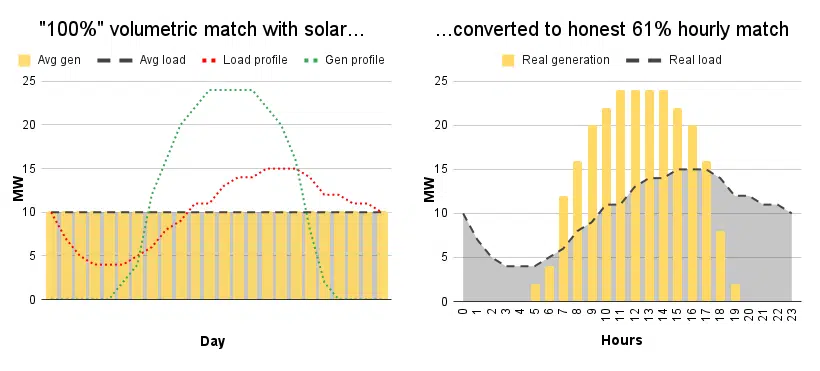

“Volumetric” annual matching functionally allows companies to offset nighttime fossil fuel use by buying extra daytime solar somewhere else. New rules would require more honest hour-by-hour matching of clean energy for the largest companies, with “load profile” feasibility measures (shown above) enabling this on day 1 with no new data or contracts needed. Data that is hourly from the start is better – and rapidly growing in availability – but even this simple conversion is more accurate than current rules.

The Virtual PPA Question

The current proposal, as written, does not provide any exemption for the new locational matching requirement, which could have implications for virtual PPAs sited in different grids from the company load (which not all of them are).

VPPAs – a financial swap where power generation can be disconnected from load – represent a significant share globally, but this is largely driven by US-based procurement. In Europe, VPPAs make up <20% of procurement. The GHGP is a global standard, and it should not be explicitly tailored to a US-centric audience. The EU even codified the higher integrity of physically delivered PPAs into their new Carbon Border Adjustment Mechanism (CBAM) law, with an hourly matching requirement to boot – it’s not just the GHGP moving in this direction.

VPPAs can offer flexibility in siting and aggregation of load across regions, but they also have more risks than physical PPAs, and they often lead to concentration of buildout (Texas is ~40% of the entire US voluntary market; Spain is ~58% of all EU VPPAs). This can accelerate cheap initial buildout, but sooner or later runs into price cannibalization, which can put companies locked into VPPAs at greater long-run financial risk. Sophisticated buyers are already realizing this, making the proposed updates a timely alignment of GHGP incentives with market incentives.

It’s also critical to acknowledge that many VPPAs are still procured in the same market boundary as company load, and so would still count in a granular Scope 2 inventory. Google and Meta, the only two companies we are aware of that have published their granular matching scores, both have granular matching scores in excess of 60% in most of their US data centres, where VPPAs are the dominant sourcing method.

Many consider cross-boundary VPPAs an important option that is better than unbundled EACs and more available than physical PPAs or supplier options. As written, proposed rules would likely account for non-local VPPAs via the parallel “consequential accounting” methodology. Considerations like this are precisely why the GHGP solicits public feedback, and why it is crucial that stakeholders provide detailed information to inform key facilitation parameters like exemptions (including their level, design, and potential exemption of deliverability requirement) to maximize the balance between integrity, impact, and feasibility. Comments to the public consultation should seek to build on and improve the Scope 2 rules, not undermine critically important reforms.

The “Consequential” Method: Separate, Not Rejected

The “consequential accounting” method, a separate process under consultation, attempts to estimate “avoided” emissions from actions taken via projects that may otherwise not fall within the updated Scope 2 “inventory accounting” rules.

This methodology can be useful for decision-making and can illustrate alternative procurement strategies, so we urge respondents to engage. We also recommend keeping in mind the well-cited weaknesses of this methodology: it is a complicated modeling exercise of unverifiable counterfactuals, using large quantities of data with questionable validity. It also requires rigorous additionality screens to ensure these are not just offsets being claimed without any real impact.

Do not be misled by claims that the GHGP Technical Working Group supports the proposed consequential framework more than the Scope 2 proposal. This is false, and public documentation from the GHGP shows (see Q12 on pages 3 and 5) that the vote referenced was simply to advance “continued development” of the metric, separate from Scope 2. That is what is happening, with maintained separation between “inventory” and “project” accounting and ongoing work to enable companies to effectively report both.

Final Thoughts

- We know what we need for a fully decarbonized grid: lots more renewables, storage, clean firm technologies, and demand flexibility. Today’s emissions accounting rules do nothing to incentivize this blend of technologies – so without critical reform, we risk a far slower, less efficient decarbonization journey.

- To argue that companies will not sign long-term offtake agreements unless they are allowed to take credit for electricity they won’t actually use or match to their actual consumption does not pass a logic or basic integrity test.

- The proposed changes to the GHGP are critical from an integrity and impact perspective. Some changes around the edges are likely, and that is why the public consultation is so important.

- Fighting for the status quo rules should be off the table (including proposals that make hourly and locational matching optional for everyone, which is just the status quo). We need to hold the largest companies accountable, ensure effective integration of renewables, and plan for full decarbonization; otherwise, we risk prolonged reliance on fossil generators.

Taken together, the proposed updates (hourly and locational matching) and feasibility measures (exemptions, load profiles, legacy clause, phase-in, etc.) seek to address shortcomings of the status quo, shaping markets to be maximally healthy and impactful now instead of waiting for their problems to deepen before considering a solution.

What YOU Can Do About All This

Respond to the consultation: the GHGP has a transparent process for soliciting feedback on their proposals. You can submit public comments through their surveys until January 31st, 2026, and several resources like this Guidebook can help walk you through it.

Spread the word: GHGP updates are being closely followed by some, but these changes will affect so many stakeholders in the energy transition and corporate procurement space. They should all be made aware of what is happening and participate in this process.