APAC Is Quietly Building the Future of Clean Power Markets – Just as Global Standards Are Being Rewritten

Asia Pacific is entering a decisive moment in its electricity transition. Governments are redesigning power markets, industries are electrifying, data centres are multiplying, and clean-technology supply chains are emerging. From China’s spot-market reforms and India’s Round-the-Clock tenders to Singapore’s cross-border imports and Australia’s temporal certificate architecture, the foundations for next-generation clean-energy markets are being laid in real time.

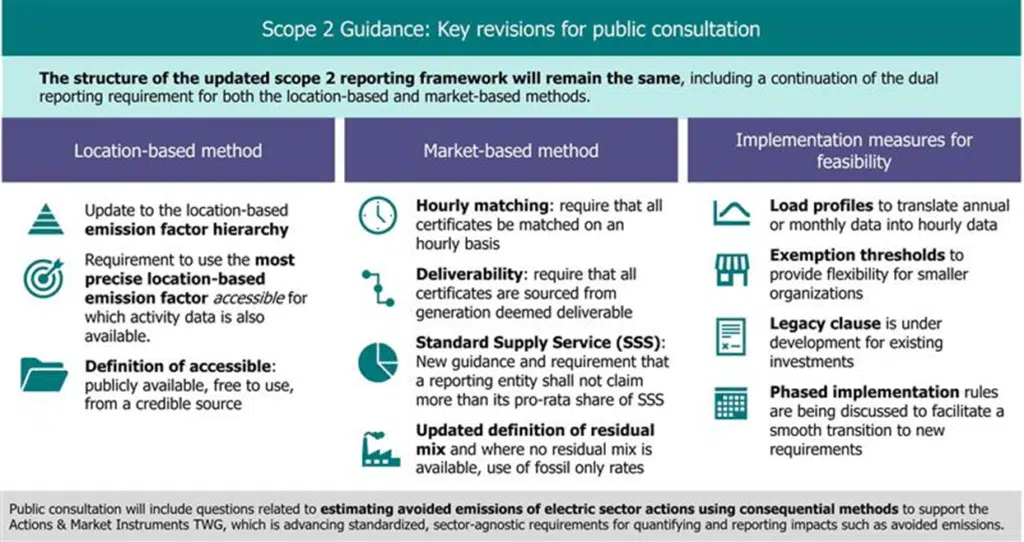

At the same time, global reporting standards and climate and energy initiatives, like the Greenhouse Gas Protocol’s Scope 2 revision, ISO14064-1 revision, the Science Based Targets Initiative’s Net-Zero Standard update, and the 24/7 Carbon-Free Energy platform, are evolving rapidly.

These changes align with challenges APAC is already facing- integrating renewables into fossil-designed grids, redesigning markets to reward flexibility, managing energy security, scaling storage and demand-side response, and ensuring clean-power claims match physical system outcomes. This approach is essential to ensuring cost-effective integration of renewable energy.

APAC is not just the world’s largest and fastest-growing electricity system; it is also assembling the capabilities these emerging standards require. The next few years will be decisive: the credibility of Scope 2 rules will depend on how they work in APAC, not the other way around.

What These Standards Are Really Trying to Do

The GHGP Scope 2 consultation draft points to a simple reality- clean-electricity reporting must begin to reflect how power systems actually operate through rules on timing, location, deliverability, and the integrity of instruments.

That means claims about clean energy use increasingly need to show that:

- The electricity was physically capable of reaching the point of consumption, not just sourced on paper, and

- The timing of that supply matters because using solar power generated at noon to claim clean consumption at midnight no longer holds up to scrutiny.

In other words, accounting frameworks are shifting from bookkeeping abstractions to system relevance. They are trying to reward clean energy that is real, delivered, and aligned with demand, rather than paper certificates that smooth over the gaps.

Source: GHGP.

Several elements are under review, including clearer rules on emission factor precision, standard supply service, and residual mix treatment, but two ideas – hourly matching and deliverability sit at the centre of the reform.

SBTi’s Net-Zero Standard revision reinforces this direction. Its Scope 2 framing moves closer to requiring claims aligned with hourly matching and deliverability, and increasingly, 24/7 CFE approaches.

Meanwhile, a new corporate initiative is rising to operationalize this ambition, the 24/7 CFE coalition, backed by The Climate Group and major corporations, which promotes an approach where “100% clean” means clean electricity matched every hour of the day, not averaged annually.

The world of electricity accounting is being rewritten. But here is the twist: the places that will make those rules real are not debating panels in the West. They are power systems across Asia.

APAC: The Region Powering the World

APAC is often framed as “hard to decarbonize.” Yet that framing misses its structural role.

The region is:

- Home to the largest share of global electricity demand.

- Growing faster than Europe and North America combined.

- The world’s manufacturing center, supplying everything from textiles to batteries to semiconductors.

- The place where data centers, EV production, and green hydrogen clusters are emerging at speed.

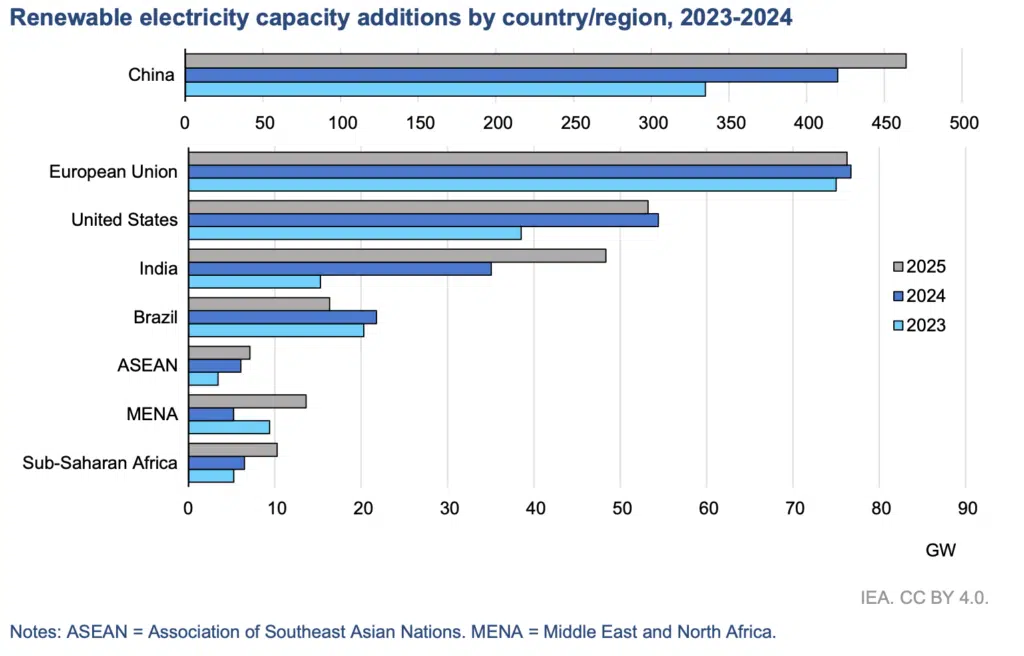

IEA data shows that APAC has a 51% share in global electricity production. About 56% of APAC electricity still comes from coal, a sobering baseline. But it also shows that renewable capacity is scaling rapidly. Between 2023 and 2024, China, India, and Southeast Asia contributed a major share of global renewable additions. Further, nearly 670 GW is expected to be added across non-China APAC markets by 2030. This is the biggest power system redesign on Earth, in real time.

This is why electricity accounting rules matter. In APAC, a misleading clean-energy claim is not just a reporting error; it can redirect investment, influence factory siting, and risk locking in new fossil generation rather than accelerating clean supply.

APAC is Starting to Lead Clean Power Market Innovation

China: From Gigawatts to Governance

China’s clean-power transformation is becoming structural:

- In 2024, renewables met ~84% of incremental electricity demand growth.

- 29 provinces now operate spot markets, with a unified national market expected by the end of 2025.

- Energy storage targets were met two years earlier than planned.

- Virtual power plants and demand response are entering market participation rules.

- Green electricity certificate (GEC) trading frameworks are evolving.

This is a full system redesign.

India: Digital Backbone and New Procurement Models

- India’s smart-metering programme targets ~250 million meters, building hourly data foundations.

- The country’s Round-The-Clock (RTC) / Firm and Dispatchable Renewable Energy (FDRE) tenders now offer firm, near 24/7 clean-power supply, combining solar or wind with storage, cheaper than coal power. For example, a recent 420 MW RTC-FDRE auction cleared at ₹5.06–5.07/kWh (~0.056 USD/kWh).

- This isn’t theoretical. Gentari’s long-term PPA to supply 650 MW RTC, carbon-free electricity for AMG Ammonia’s green hydrogen/green ammonia production involves building ~2.4 GW of wind + solar and 350 MW / 2100 MWh of storage across Andhra Pradesh and Karnataka, a real-world, dispatchable clean-energy complex designed to match industrial demand.

- RTC tendering is one of the world’s most innovative, by optimising for system needs by procuring renewables and storage together. This model was covered heavily in the recent IEA Renewables report as a best practice example.

- India already settles its wholesale markets in 15-minute intervals, a granularity many OECD markets do not have.

Singapore: Cross-Border Electricity and Traceability

- The Energy Market Authority (EMA) has granted conditional approval for 1 GW of imports from Sarawak.

- Singapore is piloting cross-border traceability frameworks in partnership with utilities and regulators.

Taiwan: Interval Data Meets Market Evolution

- Taiwan maintains 15-minute interval metering for renewable generation.

- Its T-REC system is evolving toward sub-hourly correlation in procurement. T-RECs are currently verified using 15-minute interval data from Taiwan’s Advanced Metering Infrastructure (AMI), enabling high-resolution matching of renewable generation and consumption.

Vietnam: Price Signals Driving Clean-Power Procurement

- Vietnam’s 30-minute wholesale market pricing integrates flexibility and encourages corporate renewables investment.

Australia: Regulatory Leadership in Attribute Markets

- Australia’s Guarantee of Origin framework and emerging REGO reforms are the region’s most visible step toward time-stamped electricity certificates.

- Australia is already signing 24/7 clean-supply deals – Rio Tinto’s agreement with Edify Energy includes 600 MWac of solar and a 600 MW / 2,400 MWh battery, showing firmed renewables for industry are commercially underway. Australia’s emerging REGO system will help verify this consumption at a more granular level.

Across APAC, the future architecture for 24/7 clean electricity is being tested ahead of global standards. Many markets already operate at 15- or 30-minute settlement intervals, in some cases as fast as 5 minutes, creating granular data pools that can underpin time-stamped tracking and next-generation procurement models. Check more information in EnergyTag’s APAC Factbook.

Round-the-clock Clean Energy Can Deliver a Cost-effective Transition

International Energy Agency (IEA) study for India and Indonesia, and TransitionZero’s 24/7 CFE modelling across India, Japan, Singapore, Malaysia, and Taiwan reveals something important:

- Hourly matching is cost-competitive – often cheaper than annual matching.

- Hourly matching cuts more emissions and improves system efficiency.

- Round-the-Clock clean energy steers investment into the right mix of clean capacity and flexibility.

This contradicts a dominant fear- that hourly matching means expensive storage and unaffordable electricity. The modelling suggests that when price signals and policy align, hourly matching optimizes grid investment; it does not penalize it.

The Hidden Accelerant: Supply Chains

Clean electricity accounting is no longer just a climate action question; it is becoming a requirement for globally integrated supply chains. As supply chains anchored in APAC export everything from semiconductors and batteries to textiles and green hydrogen, buyers and regulators increasingly want proof of the carbon intensity of the electricity used. Product-level carbon disclosures, border adjustments, and green-hydrogen certification mean access to key markets increasingly depends on demonstrating how clean the electricity used in production actually was, not just reporting annual averages.

This is why corporate Scope 2 frameworks are essential in Asia; they will determine access to markets.

When Accounting Fails, Systems Regress

A Financial Times investigation highlighted how weak electricity accounting allows companies to claim “clean power” even as their demand drives new fossil generation, particularly in fast-growing data-center markets.

The lesson is highly relevant to APAC; without credible time-based and deliverability rules, demand growth can cause fossil lock-in disguised as renewable procurement. That is exactly what the GHGP Scope 2 revision is trying to prevent, and exactly why APAC’s reforms matter.

The Stakes Are High: Wrong Choices Could Lock In Fossil Infrastructure

The Indiana case reported by UtilityDive, where nearly 3 GW of new gas plants are being built to power data centers while the buyer can still claim 0-emissions electricity, demonstrates what happens when clean-energy accounting does not reflect reality.

As Citizens Action Coalition – an advocacy group noted, “none of the electricity to serve the 2.4 GW of data center load will come from additional renewable energy”, the incentives allowed fossil capacity to expand while the company claimed green power on paper.

This is directly relevant for APAC. The region is seeing the same ingredients- rapid hyperscale data-center growth, rising industrial electrification, and grids where coal and gas often supply marginal demand.

Without stronger accounting rules, like those proposed in the GHGP Scope 2 revision, APAC risks repeating the Indiana outcome- fossil build-out for reliability, alongside renewable claims disconnected from actual system impact.

That is why Scope 2 integrity matters here more than anywhere. APAC must ensure growing demand drives new clean supply, not new fossil infrastructure disguised as green.

APAC is Ready to Implement

Global standard reforms now acknowledge:

- deliverability market boundaries,

- temporal matching,

- residual mix choices,

- transitional pathways.

These concepts may sound bureaucratic, but they map directly to APAC realities, i.e., China’s national market integration, India’s RTC tenders, Singapore’s cross-border trading, Australia’s time-stamped GO evolution, Taiwan’s T-REC system, Vietnam’s 30-minute market pricing evolution, etc. In other words, APAC already has the texture needed for higher-integrity Scope 2 claims.

The risk is that these standards are finalized without APAC market voices in the room, meaning- it may overlook emerging-market practicalities, or they may under-specify system design opportunities APAC has already uncovered. Both would be a mistake.

So, What Should Stakeholders Do?

For utilities, regulators, corporates, and NGOs in APAC, three actions matter now:

1. Participate, don’t observe

The GHGP Scope 2 public consultation (and SBTi consultations) will shape how APAC accounts for electricity. APAC voices are needed, and EnergyTag has published a Guidebook and companion response spreadsheet to help stakeholders navigate and submit input, whether briefly or in depth.

2. Share what’s already working

India’s RTC/FDRE tenders, China’s spot markets, Singapore’s traced imports, Australia’s time-stamped GO reforms- these are not pilots, they are evidence that APAC markets are innovating. The global debate needs these stories and insights.

3. Treat clean electricity accounting as competitiveness, not compliance

As supply chains decarbonize, credible electricity claims are becoming part of trade and investment logic. That makes coordination between corporates, system operators, regulators, storage developers, and certificate issuers essential.

The task now is to bring APAC experience into global rulemaking, and tools like EnergyTag’s Guidebook make that easier to do.